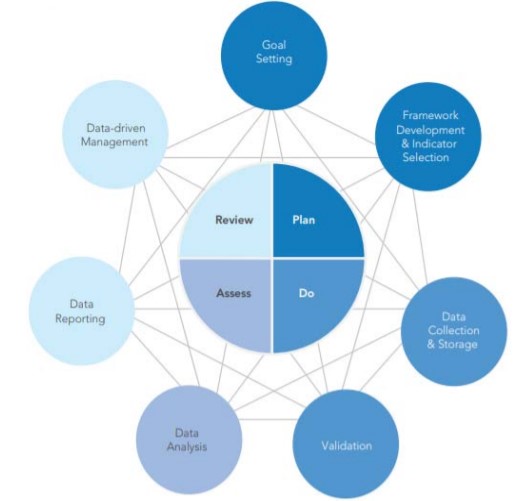

d The Group of Eight (G8) refers to the group of eight highly industrialized nations--France, Germany, Italy, the United Kingdom, Japan, the United States, Canada, and Russia—that hold an annual meeting-summit lasts for two days- to foster consensus on global issues like economic growth and crisis management, global security, energy, and terrorism. The Working Group Under the direction of the Social Impact Investment Taskforce, the Impact Measurement Working Group was established, consisting of 24 impact investing and measurement practitioners. Those who wish to implement impact measurement today face a variety of challenges. In light of this, the Working Group has identified four broad phases of impact measurement: Plan, Do, Assess and Review. Along with insight into the impact that an activity is generating, this process generates intelligence that can further enhance the measurement and investment processes. In addition, the Working Group has identified seven widely accepted activity guidelines that underlie the four phases of impact measurement. These seven guidelines provide participants with a blueprint for the effective definition, collection and analysis of impact data. As the G8’s Social Impact Investment Taskforce put it: “The better we get at measuring impact, the more money will flow into impact investment” (2014). These guidelines and related actions are dynamic. Performance measurement processes and the outputs of each step will interact and evolve continuously. The sequence, frequency, and timing of each activity will also vary. Implementation of these guidelines will be unique to every organization, as they are likely to have their own measurement goals, resource constraints, and stakeholders to consider. Nonetheless, these guidelines form a good foundation for any impact measurement framework Do you want to know more about this? Click the button and download our free Impact Measurement Guidelines. Author

Partners @i2 SustainIT The workshop, which will take place on 15.11.2021 in Brussels with the hosts Creative District, a partner organisation for the i2 SustainIT project, is approaching. This short article is dedicated to the topic that will be discussed by over 30 participants in this workshop (social entrepreneurs, mentors and investors), namely what is good for investors to know when investing in social enterprises. In general, and easily, the answer to this question sounds like this - to achieve positive impact on society and at the same time to make a profit from the money invested. But is profit only measured in money? How and why measuring the results of an investment is so important. Whether it is true for investors, that represents the motto of the social entrepreneurs themselves "Do business for good" or maybe “Invest for impact”? Answers to these questions one can find in the outputs of the project i2 SustainIT. All of us know that data has become an integral component of every kind of investment decisions, and impact investing is no exception. It’s impossible to know whether an investment is effectively delivering impact without measuring and recording its progress. The investors need reliable, standardized data. They use this information to make decisions about specific investments as well as to inform their overall strategy, with the goal of feeling confident that they’re realizing the greatest possible impact with their capital. From a bigger-picture perspective, impact measurement paired with thoughtful reporting builds industry knowledge of what works and what doesn’t. In turn, well-designed reporting illustrates the progress made toward tangible outcomes and helps raise the industry’s profile. The Global Impact Investing Network (GIIN) defines impact investments as investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return. Impact investments can be made in both emerging and developed markets, and target a range of returns, depending on investors' strategic goals. Measurement of impact is central to impact investment. As the G8’s Social Impact Investment Taskforce put it: “The better we get at measuring impact, the more money will flow into impact investment” (2014). What is Impact Measurement?This term includes these activities that investors undertake in order to evaluate and report on the financial and social change generated by an investment. Impact measurement is one of the defining characteristics of impact investing, as it demonstrates the commitment of investors to the social and environmental progress of their investments. It also allows them to feed the knowledge gained back into the business to fuel data-driven decision-making. Success as defined in a traditional business can be easily gauged using established and readily understood financial measures. In comparison, the impact performance is more difficult to identify, quantify and measure. A hallmark of impact investing is the commitment of the investor to measure and report the social and environmental performance and progress of underlying investments, ensuring transparency and accountability while informing the practice of impact investing and building the field. The Investors’ approaches to impact measurement will vary based on their objectives and capacities, and the choice of what to measure usually reflects investor goals and, consequently, investor intention. In general, the components of impact measurement best practices for impact investing include the following:

Why Measure Impact?Perhaps the most obvious reason for measuring impact is to understand the social or environmental outcomes of an investment after it has been made. However, analysts have highlighted a range of reasons for measurement, and this measurement helps guide the decision-making process at various stages of the investment.

For instance, So & Staskevicius (2015) highlight four key objectives of measurement in their analysis of 20 impact investors’ practices:

Thus, as well as providing accountability to investors and increasing investor confidence in an investment, effective measurement helps investors choose investments (by picking firms with the best environmental track record, for example) and helps explain reasons behind an investment’s success, or flop, in creating impact. |

AuthorWrite something about yourself. No need to be fancy, just an overview. Archives

December 2021

Categories

All

|

RSS Feed

RSS Feed