|

70% of investments in Europe are divided: London still leads but Paris, Amsterdam, Berlin and Barcelona follow. Milan and Rome, however, are not watching. Here we look rapidly at the first two. London

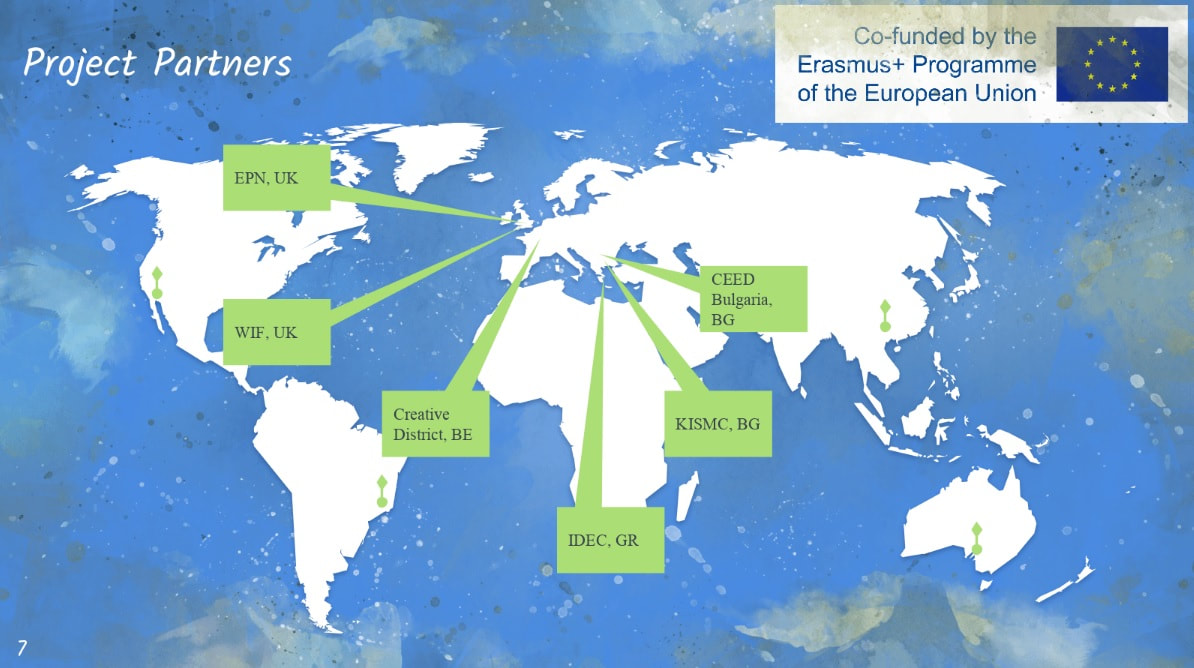

If there’s a startup Eden in Europe, it’s definitely London. Despite Brexit, the English capital boasts many records and is a leader in the number of European scale-ups in five sectors: artificial intelligence, fintech, insurtech and industry 4.0. The London startup ecosystem is the sixth largest in the world. It is located behind only New York, Los Angeles, Boston and Tel Aviv. Although still behind the top 5, the European hubs are actually the fastest and the number of exits of London start-ups has quadrupled since 2012 to date because of the Brexit. The exchange programmes that universities have implemented in European countries, and European projects such as Erasmus could therefore exclude British participants. In addition, immigrants moving to the UK are three times as likely to be entrepreneurs as those born in Britain and London will continue to be a key player in the global startup ecosystem for years to come - Brexit or not Brexit. In London, coworking spaces with multiple locations are very common and this spaces are also used to mentor and coach start-ups by accelerator program, a series of large-scale tech/startup events and meetings. There are also several support organizations from foreign governments in London. For example, JETRO supports Japanese companies that want to expand into the UK market, Tech Italia manages a support and acceleration network for Italian companies and Plugin offers support to Polish entrepreneurs. The Irish government also offers a hub for incoming founders and runs programs such as City Insights to connect Irish companies to the London ecosystem. The events are a great starting point for the founders who have just arrived in the city. At least in the first two months the founders should try to participate in multiple events like New Tech Meetup each week to expand their networks and begin to know the territory in terms of who to talk to and where to spend their time. With four of the top 10 universities in the world (Oxford University, Cambridge University, UCL and Imperial College London) in London or very close to London, the city offers a wealth of highly qualified entrepreneurship programs and services such as the K-20 accelerator at King’s College. The UK government and the local authorities of the city of London have made a big push to make London the European Tech Hub in the last decade. There are a good number of public organizations that can help foreign founders with soft-Launching in the city. The Global Entrepreneurship Program of the Department of International Trade is very useful for connecting important ecosystem actors and investors. London & Partners, the London promotion agency, is also available to help founders with tax credits and programs without taking capital in return. Paris To date, in France there are 7 unicorns, companies that are worth more than a billion dollars but when 3 years ago Macron won the elections in France, many called him "the president startupper", for the passion and determination with which he had followed the theme of innovation in his previous assignments but above all for how, Personally, he convinced the big French companies and also the international corporate companies present in France to bet on the local founders. In Paris today there is the largest campus in the world for startups, Station F. In this context, half of the employees of French startups are talented foreigners who come from the rest of the world thanks to the network of about 100 cities where La France Tech is present, the organization that represents the French startup and technology ecosystem together with Paris & Co. French Tech offers equity-free funding for initial startup costs, covering up to 70% of eligible business expenses for entrepreneurs. Since its launch thanks to French Tech, over 3,000 startups have benefited from the benefits of this government grant. At the same time the French embassy has launched the ban Yei - Young Enterprise Initiative, a competition aimed at young innovative Italian companies interested in expanding their business in France with the aim of helping them to develop and find partnerships in Paris with financial instruments and support they can use, connecting the founders with the main players in the French ecosystem. France is one of the European nations that best supported the innovation ecosystem. The PACTE Act provides for six key measures to help start-ups : it reduces staff cost thresholds and related regulations; it reduces the cost of employee profit participation; it promotes crowdfunding by opening PEA-PME accounts for investments that come from crowdfunding, such as shares, fixed-rate bonds and mini bonds; it creates a legal framework for Initial Coin Offerings (Icos) to attract innovators from around the world, and to protect themselves from fraudulent crypto offerings; it simplifies the path of researchers wishing to start or join a company by simplifying the rules that currently separate the public scientific research sector from the private sector; and it encourages the protection of industrial property by strengthening French patents. Author Partners @i2 SustainIT Under the pressure of globalization, a myriad of civil society organisations and innovative entrepreneurial initiatives have been born in Europe, aimed at meeting social needs, not strictly economic. This is an attempt to respond with new forms to a more articulated demand for goods and services of social utility, such as care, health, education, training, occupational integration, social housing, environmental protection, cultural activities, scientific research, micro-credit, meeting needs generally overlooked by the logic of the market and the public services themselves. This innovation deals with a complexity not through pre-constituted models, but involving territories and individuals. The focus is on the quality of relationships, the customization of products and services, life paths and ongoing assistance. This led to an open innovation that tends to spread ideas, enhance the contribution of all, involves users of all levels and, in addition, designs platforms to facilitate the meeting of groups of people, also creating virtual organizations. To realise its economic potential, social innovation needs to operate in a dynamic and capitalised environment, offering potential supporters or investors maximum transparency. In this perspective, the virtuous relationship between social innovation and urban and semi-urban productive systems depends essentially on three factors: human capital, social capital, territorial governance. The urban and semi-urban systems, in fact, to compete successfully and to be part of the long networks of globalization must be guided by a territorial socio-economic governance, in which to engage local public bodies, banking institutions, the manufacturing companies and the organizations that in various capacities relate to social innovation. There are already numerous cases of "second welfare", that is, partnerships on the territory between profit companies and social organizations, which also involve local public bodies and banking institutions. Despite the experience already in place, however, the question of the relationship of social enterprises in the broad sense with local public bodies and banks (and with the world of specialized finance) remains open. As for the bank-business relationship, the most obvious problem is the information asymmetry, which limits the credit granted to this type of organization, already poorly capitalized. With regard to local public bodies, the unresolved issue is their ability to take primary responsibility for territorial governance, also in view of the preponderance of public funds in this field. A social infrastructure of this kind could arise in the form of a Public-Social-Private-Partnership (PSPP), involving all stakeholders in supporting a new development model, based on the Collaborative Economy. First and foremost, local public bodies, which would have at their disposal the elements needed to redesign social policies based on the revealed needs of citizens, the dynamism of social innovation and the mobilisation of additional economic resources. For their part, citizens and their associations, through a digital market-place, would have the opportunity to freely express needs, requests and proposals, find the proximity service that best meets their needs, participate in micro-financing and supporting innovative services, as well as expressing a real-time assessment of the effectiveness and quality of the service used. While social entrepreneurs in the broad sense would benefit from the platform to broaden their catchment area, strengthen their skills, develop new services in line with demand, intercept social vouchers and crowdfunding circuits, enter the market of social finance and project both public and private in the form of grants or equity. This digital backbone for social innovation would, over time, favour the transformation of the system’s actors from "stakeholders" (stakeholders) to "resource carriers" (assetholder), through the hybridization of different realities, cultures and models. In turn, the launch of the international market-place could be preceded by the experimentation of digital platforms in the different metropolitan cities, to be integrated later. The digital platform would offer the possibility of using a transparent and guided system of authentication and certification of processes. Author Partners @i2 SustainIT Even as impact investing has expanded from a niche strategy into a $500 billion global industry in recent years, it is still relatively young. The industry’s continued growth will rely in part on ensuring a consistent and effective method of impact measurement, especially as investors start demanding information about exactly how their dollars are moving the needle on the issues they target. But standardizing this piece of the impact investing process is far from simple. From the unique complexity of each initiative to the variety of players proposing solutions, industry alignment has been difficult to achieve—and the high stakes mean development cannot be rushed. Data has become an integral component of investment decisions, and impact investing is no exception. It’s impossible to know whether an investment is effectively delivering impact without measuring and recording its progress. This is why investors need reliable, standardized data. Sophisticated investors use this information to make decisions about specific investments as well as to inform their overall strategy, with the goal of feeling confident that they’re realizing the greatest possible impact with their capital. From a bigger-picture perspective, impact measurement paired with thoughtful reporting builds industry knowledge of what works and what doesn’t. In turn, well-designed reporting illustrates the progress made toward tangible outcomes and helps raise the industry’s profile. Despite the growing consensus around the need for uniform data, efforts to standardize remain fragmented. With the Project Output - Impact Measurement Guidelines - our aim is to provide a concise and comprehensive guide for investors and mentors on the various alternatives and frameworks for measuring the impact of their investment and activities. Sign up for our newsletter below to be the first to know when the guidelines will be published. Author Partners @i2 SustainIT There are a wide range of measurement tools and approaches used within impact investment, and these are used by both investees and investors, as well as third party certifiers (e.g. for ecolabel certification). Research has found that investors tend to use a number of techniques that are suited to their specific needs. Making real social progress means using the right data—and lots of it—to evaluate outcomes, but caveats and misunderstandings abound, even among professionals in the impact measurement arena. Many organizations simply don’t have a clear, evidence-based idea of how or why their programs work, and different organizations have different ideas of what impact measurement entails. Before making important decisions about allocating resources, organizations need to first identify their impact program, where they want it to be, and how to get it there. To aid the process we would like to present some of the most recognized and widely used impact measurement frameworks. Global Impact Investing Network The Global Impact Investing Network (GIIN) is a not-for-profit organization dedicated to increasing the scale and effectiveness of impact investing. The GIIN builds critical infrastructure and supports activities, education, and research that help accelerate the development of a coherent impact investing industry. For more information, visit their website GIIN introduces the concept of Impact Measurement and Management - includes identifying and considering the positive and negative effects one’s business actions have on people and the planet, and then figuring out ways to mitigate the negative and maximize the positive in alignment with one’s goals. Impact measurement & management is iterative by nature. To access practical how-to guidance to help advance your IMM practice, refer to IRIS+ guidance. Impact Management Project The Impact Management Project (IMP) provides a forum for organisations to build consensus on how to measure, assess and report impacts on environmental and social issues. IMP convenes a Practitioner Community of over 2,000 organisations to debate and find consensus (norms) on impact management techniques. It also facilitates the IMP Structured Network – an unprecedented collaboration of organisations that, through their specific and complementary expertise, are coordinating efforts to provide complete standards for impact measurement, assessment, and reporting. IMP defines impact as a change in an outcome caused by an organisation. An impact can be positive or negative, intended or unintended. To understand and measure any impact, the Project introduces the five dimensions of performance. On the IMP page you can find them! Visit their website Study of Harvard Business School The aim of this study was to deepen the understanding of the specific practices and methodologies that established impact investors use to measure the social impact generated by their investments, and to analyse the conditions under which each measurement method is most relevant. The intended audience for this analysis are the impact investors themselves, as well as social sector organizations, traditional funders, and evaluators. Impact investors employ a number of methods to pursue their objectives. Recognizing that investors vary in their level of maturity and resources – and that their investees may also vary in level of impact measurement sophistication – is important. The Study proposes a framework that caters different integrated measurement models to each stage of investor and investee. Visit their website Social Impact Investment Taskforce The Group of Eight (G8) refers to the group of eight highly industrialized nations—France, Germany, Italy, the United Kingdom, Japan, the United States, Canada, and Russia—that hold an annual meeting to foster consensus on global issues like economic growth and crisis management, global security, energy, and terrorism. The Working Group Under the direction of the Social Impact Investment Taskforce, the Impact Measurement Working Group was established, consisting of 24 impact investing and measurement practitioners. The Working Group has identified four broad phases of impact measurement: Plan, Do, Assess and Review. Along with insight into the impact that an activity is generating, this process generates intelligence that can further enhance the measurement and investment processes. Visit their website World Business Council for Sustainable Development / International Finance Cooperation In 2006 WBCSD and IFC have joint forces to create a clear and practical measurement methodology that could be adapted to different business sectors, be used by operations anywhere in the world and be tracked over time. Unlike environmental impact assessments (EIAs) or environmental, social and health impact assessments (ESHIAs) that are normally carried out as part of due diligence to determine future potential impacts arising from a greenfield or brownfield business investment, they wanted to be able to measure actual impacts at any stage in the life cycle of an operation. The resulting Measuring Impact Framework is designed to help companies understand their contribution to development and use this understanding to inform their operational and long-term investment decisions and have more informed conversations with stakeholders. Visit their website The Investment Integration Project TIIP’s mission is to help institutional investors understand the feedback loops between their investments and the planet’s overarching systems – be they environmental, societal or financial – that make profitable investment opportunities possible. TIIP also provides these investors with the tools to manage the impacts of their investment policies and practices on these systems. TIIP offers investors a framework for where to focus and how to build an effective approach. Going beyond traditional returns metrics, the framework analyses how to consider and target appropriate goals. The TIIP proposal focuses on “system-level” investments, or big-picture issues like the United Nations’ Sustainable Development Goals. Visit their website Principles for Responsible Investment The PRI is the world’s leading proponent of responsible investment. It works: to understand the investment implications of environmental, social and governance (ESG) factors; to support its international network of investor signatories in incorporating these factors into their investment and ownership decisions. The PRI acts in the long-term interests: of its signatories, of the financial markets and economies in which they operate and ultimately of the environment and society as a whole. The PRI is truly independent. It encourages investors to use responsible investment to enhance returns and better manage risks, but does not operate for its own profit; it engages with global policymakers but is not associated with any government; it is supported by, but not part of, the United Nations. Responsible investment is an investment strategy which integrates environmental, social, and governance (ESG) factors into investment analysis and decisions. It recognises that ESG factors can have an impact on the financial value of an investment and also that investments have an impact on the world around us. Visit their website Author Partners @i2 SustainIT On 19 October 2020 all partners in the Impact Incubator for Nurturing Sustainability - i2 SustainIT project gathered online for the 2nd project meeting which due to Covid-19 had to be organised virtually, hosted by the project partner from Bulgaria: CEED Bulgaria and supported by Knowledge, Innovation and Strategies Management Club (KISMC). The rest of the project partners: EPN Consulting, IDEC, Worldview Impact Foundation and Creative District participated virtually from UK, Greece and Belgium. The project has been co-funded by the Erasmus+ Programme of the European Union for its 2-years' implementation.

Each partner had the chance to talk about the impact investment and sustainability ecosystem in their country whereas many case studies encouraged interesting discussions comparing the ecosystems in a variety of European regions. Furthermore, the main topic discussed was related to the current situation in each country and the risk management and mitigation plan which is of paramount importance to have the flexibility of adapting quickly to any possible challenges arising due to the pandemic. The meeting was also focused on discussions about the project management activities led by EPN Consulting; dissemination strategy, financial and administration details. All partners agreed on next steps and the evaluation and quality assurance framework for the project. Another aspect touched during the meeting was about the 3rd meeting supposed to take place in Greece along with the 1st training under the project. Moreover, CEED Bulgaria which is leading the 1st Intellectual Output of the project - Impact Measurement Guide (IMGuide), presented its structure, tools and each partner's role for supporting its development. Additionally, the project partners had a discussion on the output framework and suggestions for the content of the model and the main concepts, as well as previous and ongoing Erasmus+ projects related to the main topic of i2 SustainIT. KISMC also opened the floor for discussion on the 2nd Intellectual Output - Design Thinking for Impact Incubation Toolkit (DTi2 Toolkit) and relevant updates to share with the partners. IDEC updated the consortium with progress on the 4th Intellectual Output - Digital Impact Incubator Platform (Di2 Platform). During each meeting all partners aim to have a proactive catch up on the dissemination activities led by Creative District. To learn more about the project, check our first blog article for the kick off of i2 SustainIT project: Impact Incubator for Nurturing Sustainability' Virtual Project Kick Off from London [i2 SustainIT]. Author Partners @i2 SustainIT We see how in recent years the world of impact investing continues to grow more and more, many people say it is the future that comes to save the present! Everyday, there are more and more courses and trainings around the subject, it is talked about in the DAVOS forum and in all kinds of notable publications in the economic space. But in reality, it is sometimes difficult to understand what impact investing is. Tesla with its electric cars, vaccines against COVID, Goldman-Sachs saying that they generate impact through investment in telecommunications... Impact investing seems like a very open concept and in order to facilitate a better understanding of the concept itself, we would like to introduce you a selection of keywords. Therefore, because we want to help you make an impact, we have prepared a glossary that will help you and ease the way to create a better tomorrow. Impact Investment TerminologyLike all terminology, each of these words has its advantages and disadvantages. Creating a consensus around the meaning of a word means that we can speak a common language, facilitating the understanding of impact investing and attracting new participants or investors.

Author Partners @i2 SustainIT On 16-17 June 2020 the i2 SustainIT project kicked off with a meeting virtually hosted from London, UK. All partners – the project coordinator EPN Consulting and the project partners KISMC, CEED Bulgaria, IDEC, Worldview Impact Foundation and Creative District – launched Impact Incubator for Nurturing Sustainability - i2 SustainIT [Project No. 2019-1-UK01-KA204-061873]. The project has been successful in the Erasmus+ call in 2019 and consequently co-funded by the Erasmus+ Programme of the European Union for its 2-years' implementation. Erasmus+ is the European Union’s (EU) programme for education, training, youth and sport, with the EU committing £12 billion to the programme between 2014 and 2020. During the virtual kick off meeting all partners discussed their previous experience in the topics of impact investment and sustainability and agreed on an agenda that would focus on producing quality intellectual outputs that would assist all stakeholders in the impact investment and social entrepreneurship ecosystem. What is i2 SustainIT?The Impact Incubator for Nurturing Sustainability [i2 SustainIT] project inspires more connectivity in the social and environmental ecosystem through the United Nations Sustainable Development Goals. The project's duration is 2 years, to be completed in the end of September 2021 with an Impact Investment & Sustainability Conference. Although the project has a set end date for its implementation under the Erasmus+ Programme of the European Union, we are firmly willing to continue contributing to this topic by using i2 SustainIT as an already established network and community to create social value and assist finding solutions to the world’s problem our society faces. The i2 SustainIT is a continuation of another project, co-funded by the Erasmus+ programme. The project is BASET – Boost Aid for Social Entrepreneurship through Training with the overall objective to foster social entrepreneurship in Europe through elaborating, testing and providing a set of learning and training instruments to a large group of social entrepreneurship trainers/educators. The rationale behind continuing BASET is the realisation that such a project focused on social entrepreneurship aiming to provide a higher-scale of impact, will need a more sustainable approach and additional set of instruments to assist educators and investors; in the i2 SustainIT project – mentors and investors. i2 SustainIT focuses on the fact that all target groups need to better communicate with each other and express their needs accordingly, and also that impact investment and sustainability are under-explored topics with significant added value to tackling social and environmental challenges. In the next section you can read more information about the project's objectives, methodology, results, impact and learn more about the partners involved in this exciting project which will contribute to the social entrepreneurship ecosystem in Europe and beyond.

|

AuthorWrite something about yourself. No need to be fancy, just an overview. Archives

December 2021

Categories

All

|

RSS Feed

RSS Feed